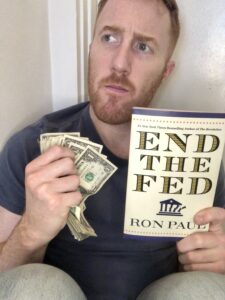

“Follow the money,” says the snitch to the protagonist, just before they are taken away to jail. How many times have we heard a similar line like this in the movies and watched a similar scene unfold? Countless times, of course, because it is a well-known maxim in today’s culture: Money is the base of power for the powerful.

“Follow the money,” says the snitch to the protagonist, just before they are taken away to jail. How many times have we heard a similar line like this in the movies and watched a similar scene unfold? Countless times, of course, because it is a well-known maxim in today’s culture: Money is the base of power for the powerful.

Therefore, it makes sense that when analyzing the roots of power of the government of the United States of America, we should similarly follow the money. Ostensibly, the government collects money in the form of taxes from its citizens, and uses that money to carry out the desires of those same citizens. What does the government do when it has more expenditures than income? It borrows money from the bank, the same as you or I.

Banking in America (and the western world in general) has been following foolish practices for decades. A bank has two main functions: 1) to store our money safely and allow us access to it when we want/need it, and 2) to loan it out (to commercial ventures or for real estate investments, for example) in the hopes of making a profitable return. Foolishly, banks have combined these two services in a practice called ‘fractional reserve banking,’ where money that was earmarked for storage becomes the money used for lending. That newly loaned money is deposited yet again, which is then loaned out again and deposited again, “with each depositor treating the loan money as an asset on the books.” In this way, banks create new money, pyramiding new deposits on top of a fraction of old deposits. The amount of money in a bank at any given time is only a fraction of the amount they have recorded in their books.

We like to think that we have access to our money whenever we want it, but we do not. If enough people try to withdraw their money at the same time, and the bank cannot provide them all with the funds, it can simply shut its doors and refuse to pay. To avoid this, and in order to keep the banking system functioning, The Federal Reserve has agreed to back up the fractional-reserve system with a promise of bailouts and money creation. Basically, if the money is ever not there (for banks that are correctly allied), the Fed will print it out of thin air. This is where the core of the problem exists: the Fed’s ability to print money.

The biggest borrower of money is the federal government, and we have reached a point in history where our expenditures far outweigh our income. The solution has been to print the difference, a practice called deficit financing. Over time, the government has become fully backed by the Fed and its infinite money printing machine, and this is how we have become trillions of dollars in debt. “It is no coincidence that the century of total war coincided with the century of central banking,” Paul writes. “Imagine an irresponsible teenager with an unlimited line of credit. The parents, teachers, pastors, and authorities in his life are ultimately powerless to change his habits. Now imagine that teenager armed to the teeth and also immune even from the rule of law. This is what we have with a government backed by a central bank.”

The gold standard (that America abandoned in 1971) worked like a regulator. Before they were guaranteed a bailout (and, in effect, immunity from poor investment decisions), banks had to function like every other business: they could expand and make risky loans if they desired, but when faced with bankruptcy, they had nowhere to turn. They would have to contract loans and deal with extreme financial pressures. “Risk bearing is a wonderful mechanism for regulating human decision making.” Adherence to the gold standard created a culture of banking and lending discipline. Once we moved away from commodity money to fiat currency, our money has been inflating.

In addition to the century of foreign wars enveloping the world since the creation of the Fed in 1913, we have seen a colossal growth of the government in general. We must remember that there is always a trade-off, and that when government grows, liberty suffers. Democracy requires a balance in power between the people and their government, but the bigger the government grows, the more power it gobbles up for itself, and the more it becomes tyrannical. This happens no matter what justification is given for the government programs being financed; it is brought upon its citizens via its growth. And, of course, it cannot grow without being financed.

The logical conclusion to our search for the collective problems of America, then, is The Federal Reserve. Money is power, and when a government is able to produce its own money, it is able to produce its own power. This is what we are seeing with the inflation of the money supply today: The elite members of society are getting richer while the purchasing power of everyone else’s dollar declines. Economist John Maynard Keynes (before he changed his tune and became a champion of inflation) wrote quite correctly of the grave danger of inflation in his book The Economic Consequences of the Peace: “Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

The Federal Reserve has been around for so long and has become such a fundamental tool of government use that we take its existence as mandatory. This does not have to continue, however. What would happen, as our author hopes, if we were to abolish it? The people would “enjoy all the privileges of modern economic life without the downside of business cycles, bubbles, inflation, unsustainable trade imbalances, and the explosive growth of government that the Fed has fostered.” We would also be able to disempower the secretive cartel of powerful money managers who exercise disproportionate influence over the conduct of public policy. In essence, it would hobble the ability of the government (the largest and most powerful government humanity has ever known) to do whatever it wants. If we the people ever want to hold our government accountable, we must follow one single, simple piece of advice: follow the money.